What is RFM?

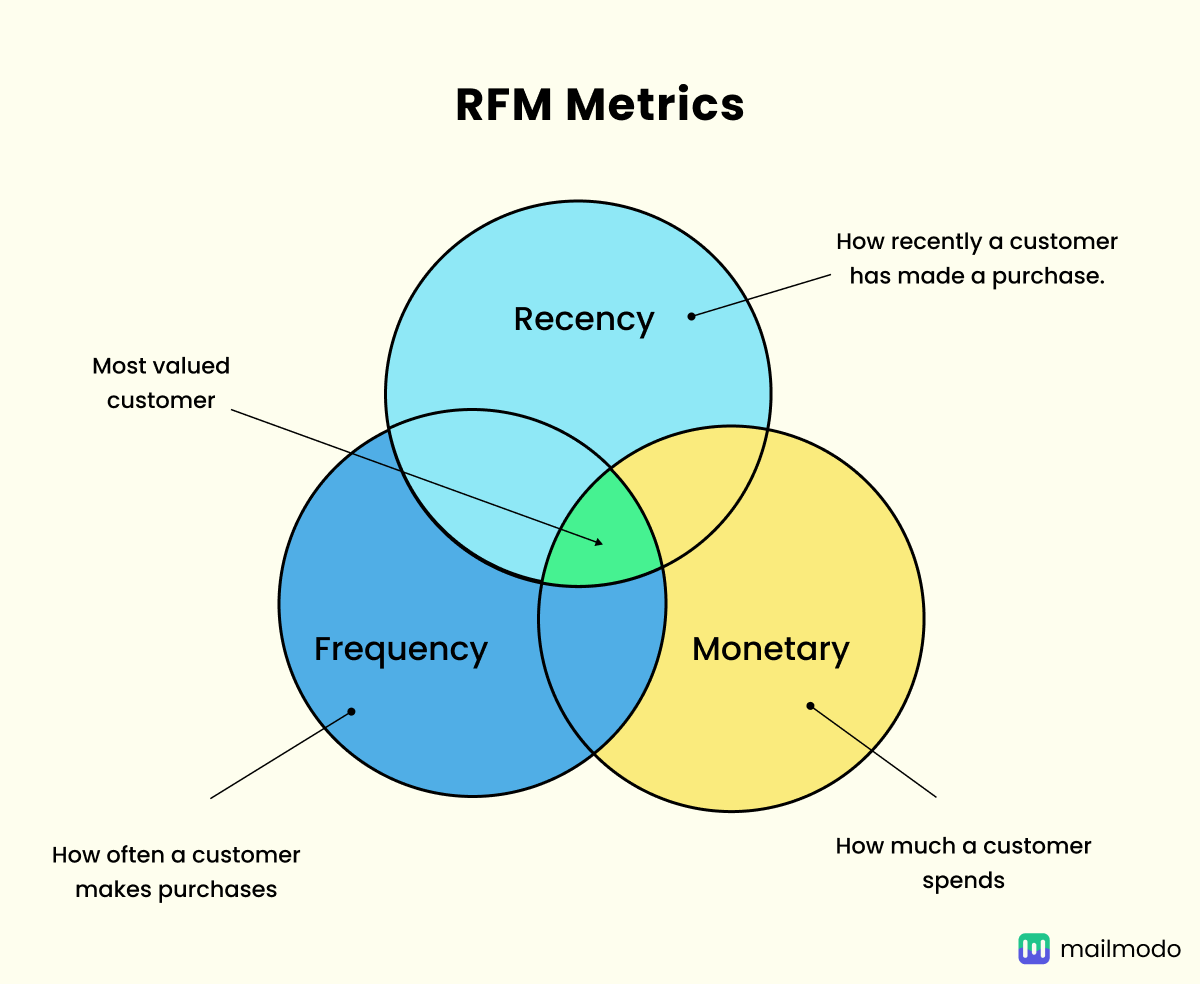

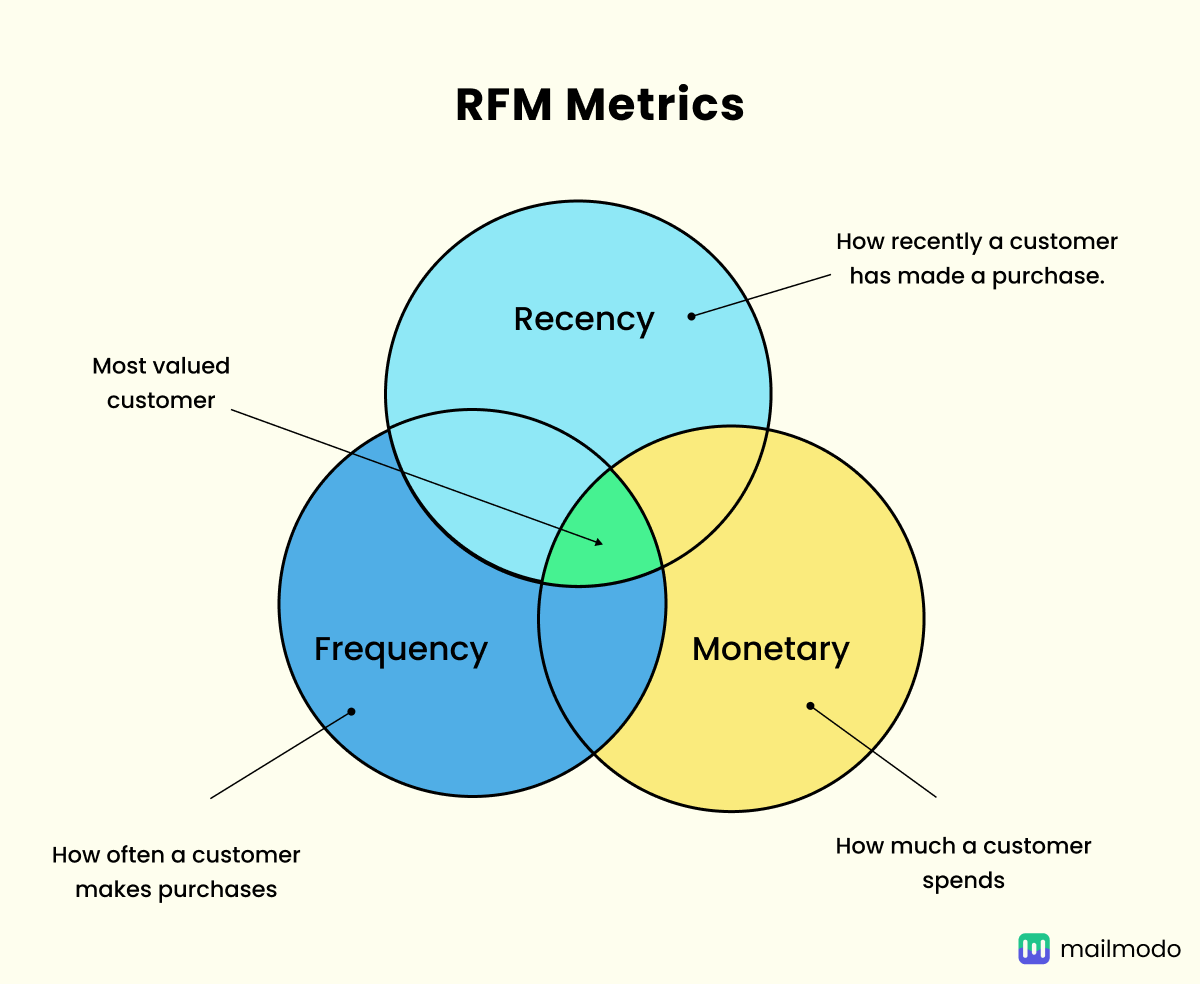

RFM is a marketing analysis technique used for segmenting customers and analyzing their value based on their purchasing patterns. This method helps businesses segment customers and identify the most valuable customers by focusing on three key factors: recency, frequency, and monetary value.

What are RFM metrics?

RFM metrics refer to key metrics used in RFM analysis. These metrics make it easy to understand and analyze customer behavior. Let’s take a look at the metrics one by one.

Recency(R): It measures how recently a customer made a purchase. A scoring system ranks recency on a scale from 1 to 5, where a score of 5 indicates a recent purchase.

Frequency (F): It assesses how often a customer makes purchases in a specific time period. Customers who buy frequently are considered more valuable and are assigned a higher score on the same scale.

Monetary value (M): It evaluates the total amount of money a customer has spent over a specified time period. Customers who spend highly are important for driving revenue for the business and are thus scored higher.

Let’s understand this better with an example. Imagine a customer named Clara who shops frequently at an online retail store. Let’s take a look at her purchasing behavior.

Last purchase: 1 day ago

Total purchases in the last month: 20

Total spending: $200

So, from here, we can say that:

R = 5 (Since she made a purchase very recently)

F = 5 (Since she has made a high number of purchases in the last month)

M = 2 (Since her total spending is pretty low)

It’s also important to note that the scoring isn’t standardized and that it may vary from business to business and industry to industry. This is because a car dealer may consider 2 purchases in a year as high frequency and assign a score of F as 5, while a brand selling shoes online may consider the same as a low frequency and assign a score of 1 or 2.

Why is RFM analysis important?

RFM analysis helps businesses to identify and segment valuable customers depending on their purchasing behavior. By focusing on the insights and the overall score obtained through RFM analysis, businesses can target their marketing efforts to customers who contribute most to revenue. For example, customers with high RFM scores can be targeted with loyalty programs and personalized offers.

💡 Related guide: What Is a Customer Loyalty Program and How to Set It Up?

It also helps identify at-risk customers who have not made enough purchases. Businesses can target them with re-engagement campaigns and spark their interest in their offerings.

So, RFM analysis enables companies to prioritize their marketing campaigns; rather than spreading efforts across the entire customer base, they can direct campaigns toward customers likely to respond positively, leading to efficient allocation of marketing resources.

How to do RFM analysis

RFM analysis is simple and straightforward process. Here’s how to do it:

Before you start doing RFM analysis, you must collect the relevant data on all customer transactions, including purchase date, total number of purchases, and total spending.

Then, you need to score customers on each of the three factors— (Recency, Frequency, and Monetary) on a scale, typically from 1 to 5, with 5 being the highest value. You must have a standard for this scoring, as shown in the table below.

| Score |

5 |

4 |

3 |

2 |

1 |

| Recency (R) |

Purchased today |

Purchased last week |

Purchased last month |

Purchased in last 2-3 months |

Purchased more than 3 months ago |

| Frequency (F) |

20+ purchases |

15-19 purchases |

10-14 purchases |

5-9 purchases |

1-4 purchases |

| Monetary value (M) |

$500+ |

$300-$499 |

$100-$299 |

$50-$99 |

Below $50 |

Note: The above table is for your reference only.

Once you have assigned the scores, you can proceed to calculate the RFM score. You can either use addition or weighted average to find the score. Here’s how:

| Customer ID |

Recency score |

Frequency score |

Monetary value score |

Total score by addition |

Total score by weighted average |

| C001 |

5 |

5 |

5 |

15 |

5 |

| C002 |

4 |

4 |

4 |

12 |

4 |

| C003 |

4 |

3 |

2 |

9 |

3.3 |

| C004 |

3 |

2 |

2 |

7 |

2.6 |

| C005 |

1 |

1 |

3 |

5 |

1.7 |

What should you do after RFM analysis?

Once you have completed the RFM analysis, you will have a clear picture of the value each customer brings to your business. Now, you need to segment your customers and target them well. Here’s how:

1. Segment your customers

After scoring, group your customers into segments. Some common segments include:

Champions: They are the most valuable or high-spending customers who have made recent purchases, buy frequently, or spend high amounts of money.

Loyal customers: They purchase often and have made high-value purchases recently but may not be spending high amounts of money.

Potential loyalists: They spend money but may not have purchased frequently.

At-risk customers: They haven’t been buying recently but were frequent purchasers in the past.

2. Create targeted marketing strategies

Now that you have defined customer segments, the next step is to target each segment with strategies that align with their behavioral pattern. For instance:

Loyalty programs, exclusive products, and services for champions.

Personalized recommendations, discounts, and coupon codes for loyal customers.

Targeted promotions or limited-time offers for potential loyalists.

Personalized messaging and re-engagement campaigns for at-risk customers.

Conclusion

Not all customers need the same level of attention. The RFM models help you figure out which customers are most important and which ones need a little more attention. By analyzing using the RFM model, you get actionable insights to segment your audience. This helps you to focus on what matters most, build stronger relationships with your top customers, and drive growth and revenue.